In May of 2015, I registered my domain at kenstrends.com and began posting my thoughts on Commercial Real Estate, Technology, South Florida, and any other stream of consciousness that I thought would be interesting to my audience. I began to post online, developed an e-mail list now nearing 1,000 subscribers, posted to my social channels, and syndicated through The Broker List and others.

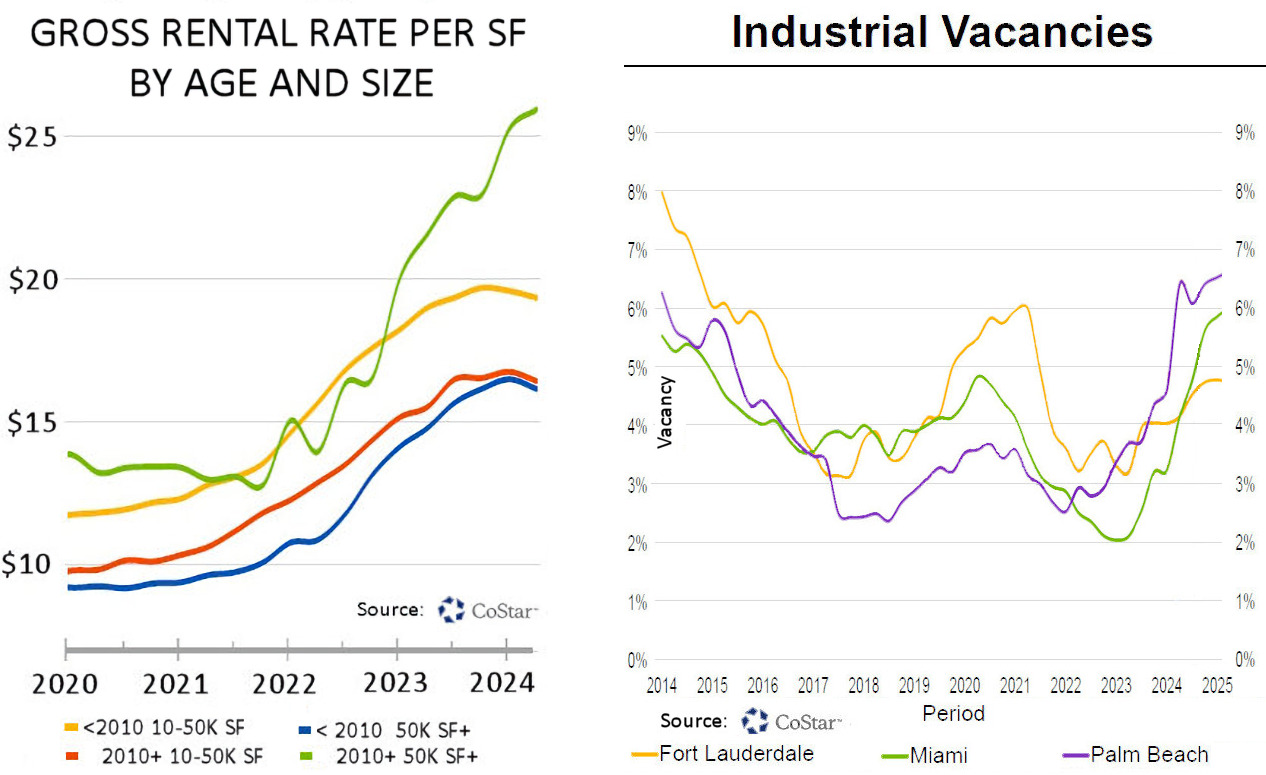

It goes back to my early career as a market analyst. I wrote my first report on the Miami Office market in the late 1980s, then broadened my scope to include industrial and expanded my focus into Broward and Palm Beach Counties. I’ve always had a knack for identifying trends and adding my own brand of color to otherwise monotonous market statistics. Hardly a week went by when I wasn’t quoted in a local or national publication. People wanted to hear what I had to say and that remains true today.

I wrote my first blog article on my company’s site in 2011 and continued posting on company sites and industry blogs until 2015, when I decided to create my own digital soapbox at kenstrends.com. I always try to be timely and tackle important issues of the day. A lot of the information is timeless and remains relevant – and many of my predictions came true. I sometimes find myself going back to my old articles and thinking “this is really good – it’s a shame more people don’t get to see it.” So, as a public service, I have selected the KensTrends Top Ten. Are they the best? Are they the most important? Maybe not, but these are my personal favorites and there are many more good ones. I hope you enjoy them and I hope you will continue to enjoy my articles in the future and follow me on Twitter and Linked-In. Rather than count down, here are Ken’s favorite trends from 1 to 10.

- The Top Ten Kens. (2023) I always cover Trends, this is my only post about Kens. I offered it to Buzzfeed, but never got a response – their loss. Especially when I released it just before the premiere of the Barbie Movie, which I correctly predicted would be the runaway hit of 2023. I think it’s some of my best work, even though it has nothing to do with real estate. And using my graphics expertise, I was able to edit my logo to Barbie pink.

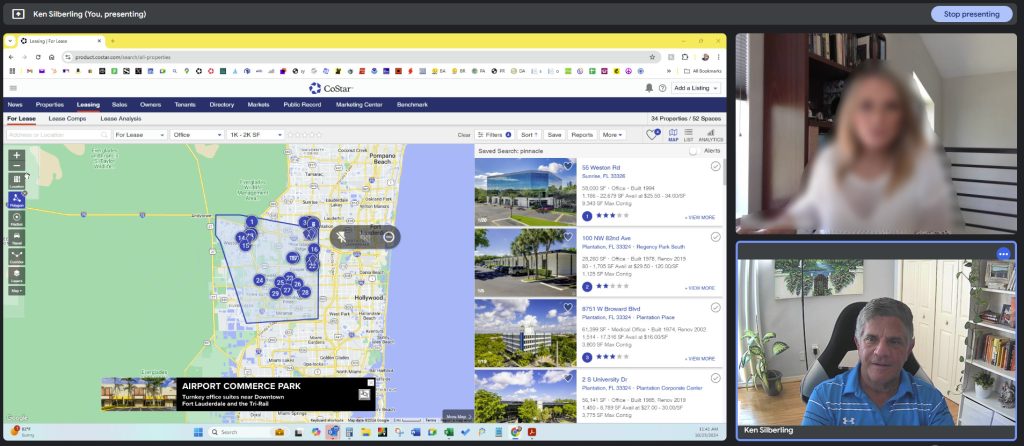

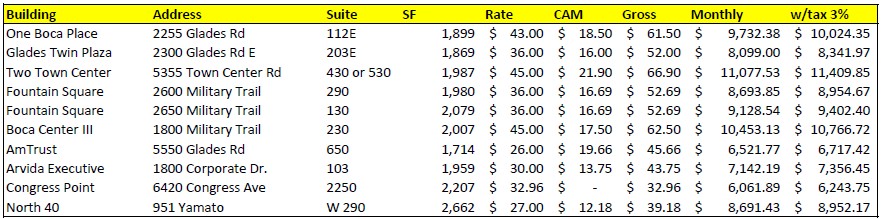

- Tenant Representation 2024 – How I Do it and Why You Should Work With Me. A prominent property owner in South Florida recently asked me, “What do you do?” I have done a lot in a real estate career that goes back well over 30 years. For the past 7 years, a majority of my time has been spent representing tenants and buyers finding the best deals on the ideal space. This recent post provides a step-by-step desct explores what I do, how I do it and why I am one of the best.

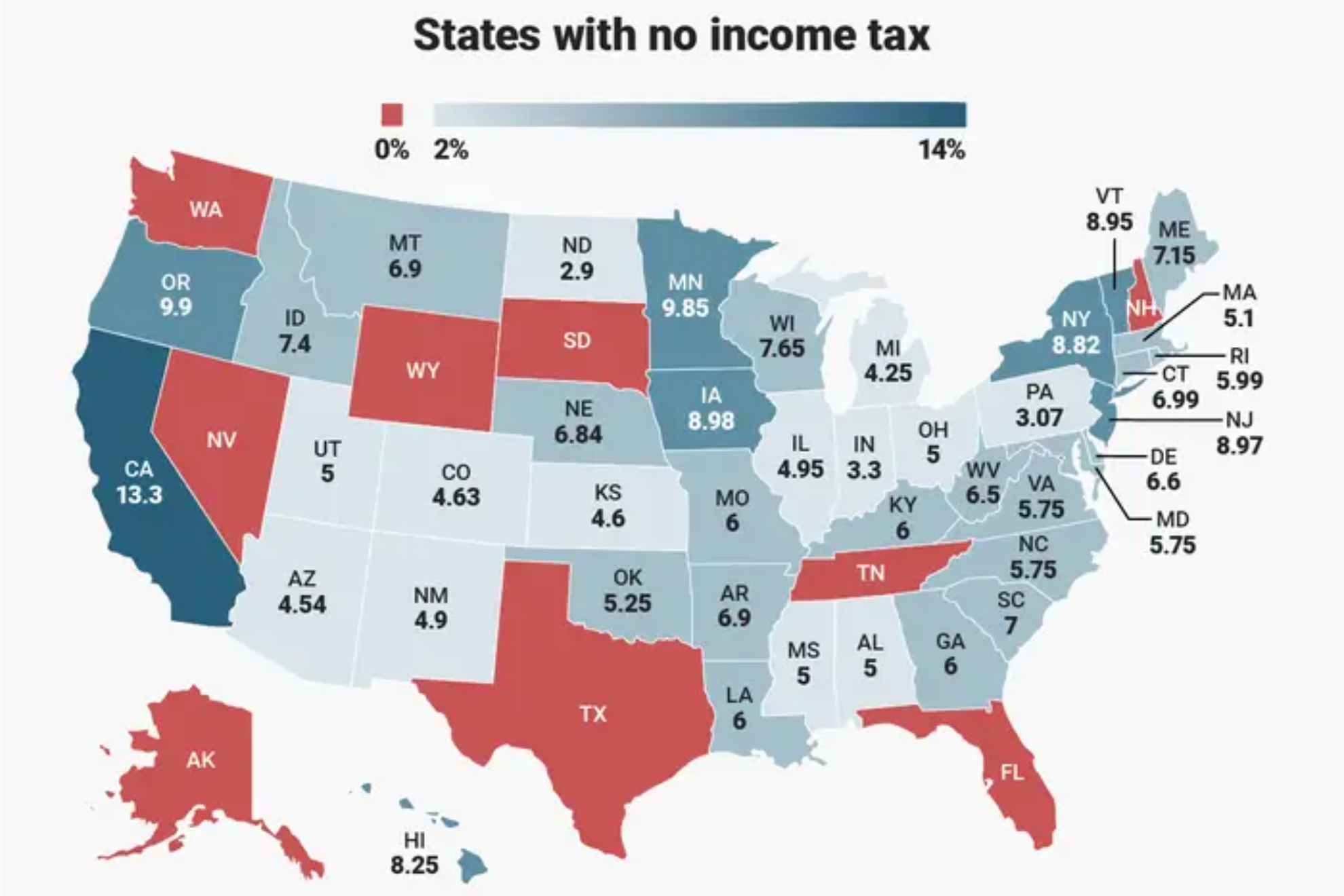

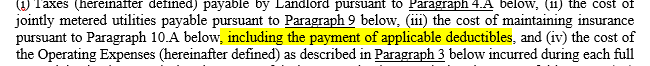

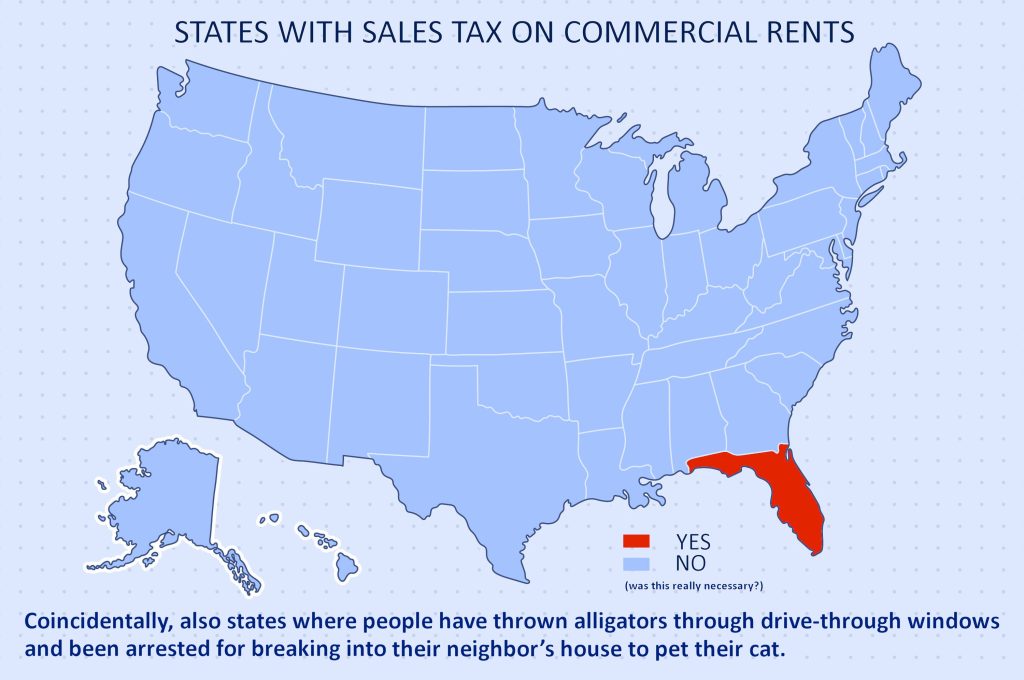

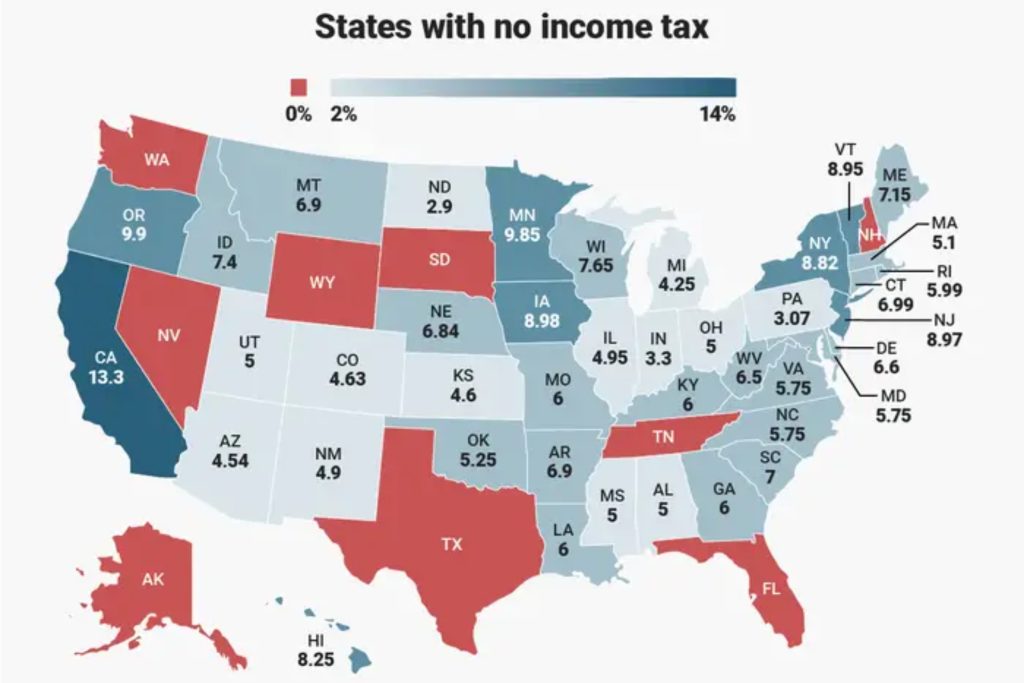

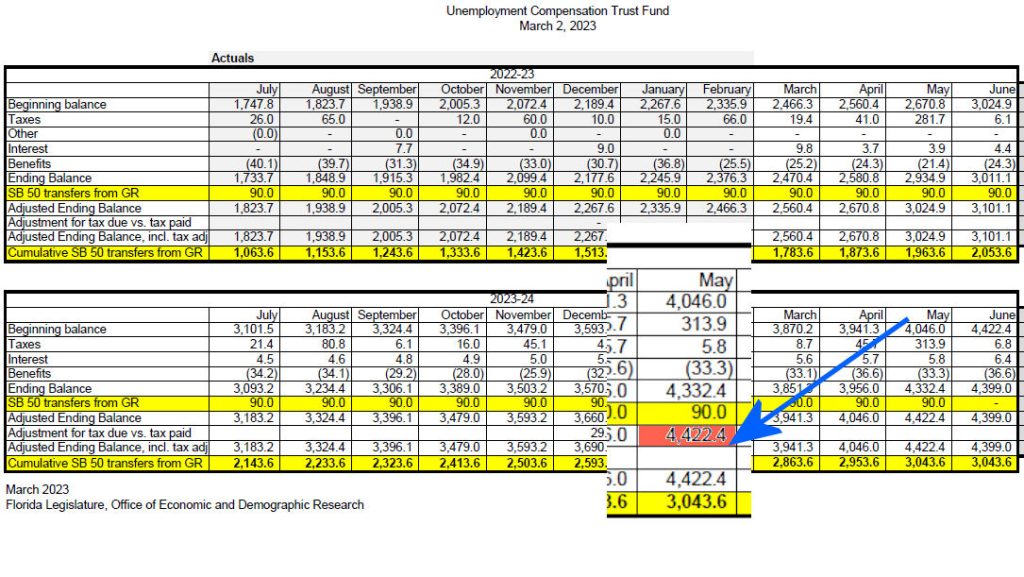

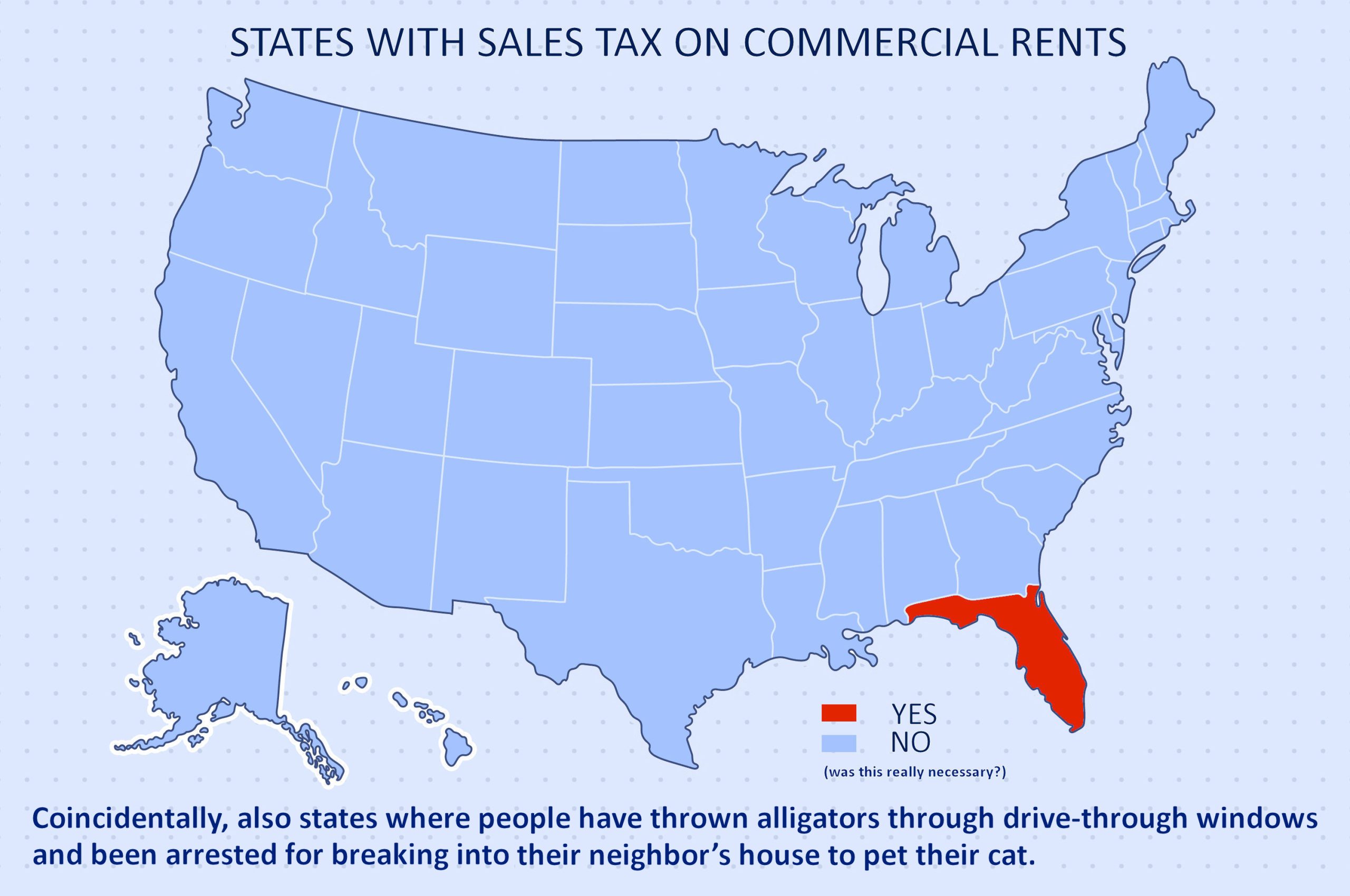

- What Makes Florida Unique? Sales Tax On Commercial Rent – But Changes On The Way. (2017, 2023, 2024) This is a recurring series. What puts it among my favorites, is that I did my own research and had this news before the local news media. More reason that KensTrends should be required reading. I was also able to post a great original map to one of my favorite twitter follows, Terrible Maps.

- The Top Two Reasons To Use A Tenant Representation Specialist (2021) – I am always selling my tenant representation services. This hammers home why you need me on your team as a trusted advisor.

- Tenant Representation – The Best Deal in Commercial Real Estate? (2021) One more compelling reason to work with me. Tenant representation is essentially a free service. Is there a pattern emerging here? It seems many of my favorite articles involve why you should work with me.

Tryin’ to Reason with Hurricane Season (2012 updated in 2022) – As the calendar turns to May, another hurricane season is upon us. I stole the title from Jimmy Buffet. Before things start getting serious again, this was a humorous look at Hurricanes and the relentless efforts of the media to keep you glued to the screen. Warning – if Jim Cantore is in your backyard, it may be time to evacuate.

Tryin’ to Reason with Hurricane Season (2012 updated in 2022) – As the calendar turns to May, another hurricane season is upon us. I stole the title from Jimmy Buffet. Before things start getting serious again, this was a humorous look at Hurricanes and the relentless efforts of the media to keep you glued to the screen. Warning – if Jim Cantore is in your backyard, it may be time to evacuate. Ghostbusters – Please Join Us! (2021) One of my Halloween specials: This is my number one pet peeve. My promise to my readers and to my clients is that I will always communicate. If it’s bad news, rip off the band aid and let me know. You never know when our paths will cross again and no reason to keep carrying that guilt. Ghosting must go. Be a ghostbuster!

Ghostbusters – Please Join Us! (2021) One of my Halloween specials: This is my number one pet peeve. My promise to my readers and to my clients is that I will always communicate. If it’s bad news, rip off the band aid and let me know. You never know when our paths will cross again and no reason to keep carrying that guilt. Ghosting must go. Be a ghostbuster!

- Leasing, Sustainability and Why My Glass of Buffalo Milk is Half Full – Happy Holidays! (2018) Occasionally I am able to take KensTrends on the road. I love to travel, and am very interested in how technology can help us sustain the environment. I normally write about office leasing, which gave me an added appreciation for buffalo leasing. And being halfway around the world, I was able to wish my readers a Happy New Year twelve hours early.

- Expert Insights: Ken Silberling on CRE in the Time of COVID-19. The subject was very important. We were two months into the pandemic when I was interviewed for an article on Commercial Café. What I like here was that I was able to get national coverage for my little blog. I also used the downtime during COVID to add audio and video to my repertoire. Looking back five years later, I got a whole lot right.

- Special for 4/20: CBD vs. CBD – A New Definition for a Key Term in Commercial Real Estate. (2020) Still my most popular article. Early in my career, I had to check a real estate glossary to find out that CBD meant: Central Business District. In 2020, I spotted a more popular definition for CBD and a perfect topic for a KensTrends investigation, especially when the date was 4/20.

So there you have it. Ten years of work, hundreds of sales and leases in Miami-Dade, Broward and Palm Beach Counties and around 78 blog posts. Looking ahead at the next ten years, my aim is:

- To continue to leverage my knowledge, experience and expertise to provide my clients with the best value on the ideal space for their companies.

- ABC – Always be Communicating. It’s never been easier with texts, emails, social posts, blogs. Most importanly I had a sales trainer who used to say PUTT – “Pick up the Telephone.” I ammended that to PUTFT for added emphasis. But people seem to be less and less likely to do so. Communication is the foundation of everything I do, and is how deals get done.

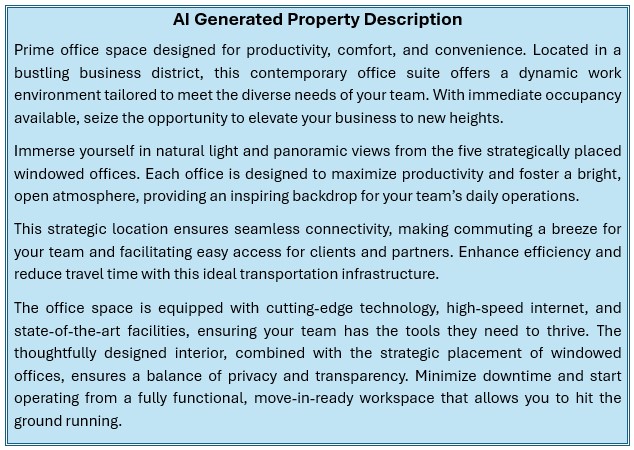

- To sharpen my skills. For well over 30 years in Commercial Real Estate, I have had a reputation for being on the cutting edge of technology. I am always looking for ways to do my job better. As we enter the age of AI, we all need to push forward or risk being left behind.

- Show up. It was Woody Allen who said the 80% of success is just showing up. When I see an opportunity, I jump on it. Whether or not you’re a fan of Woody, it comes down to telling people what you can and will do, doing it, and exceeding expectations. (And also see #2)