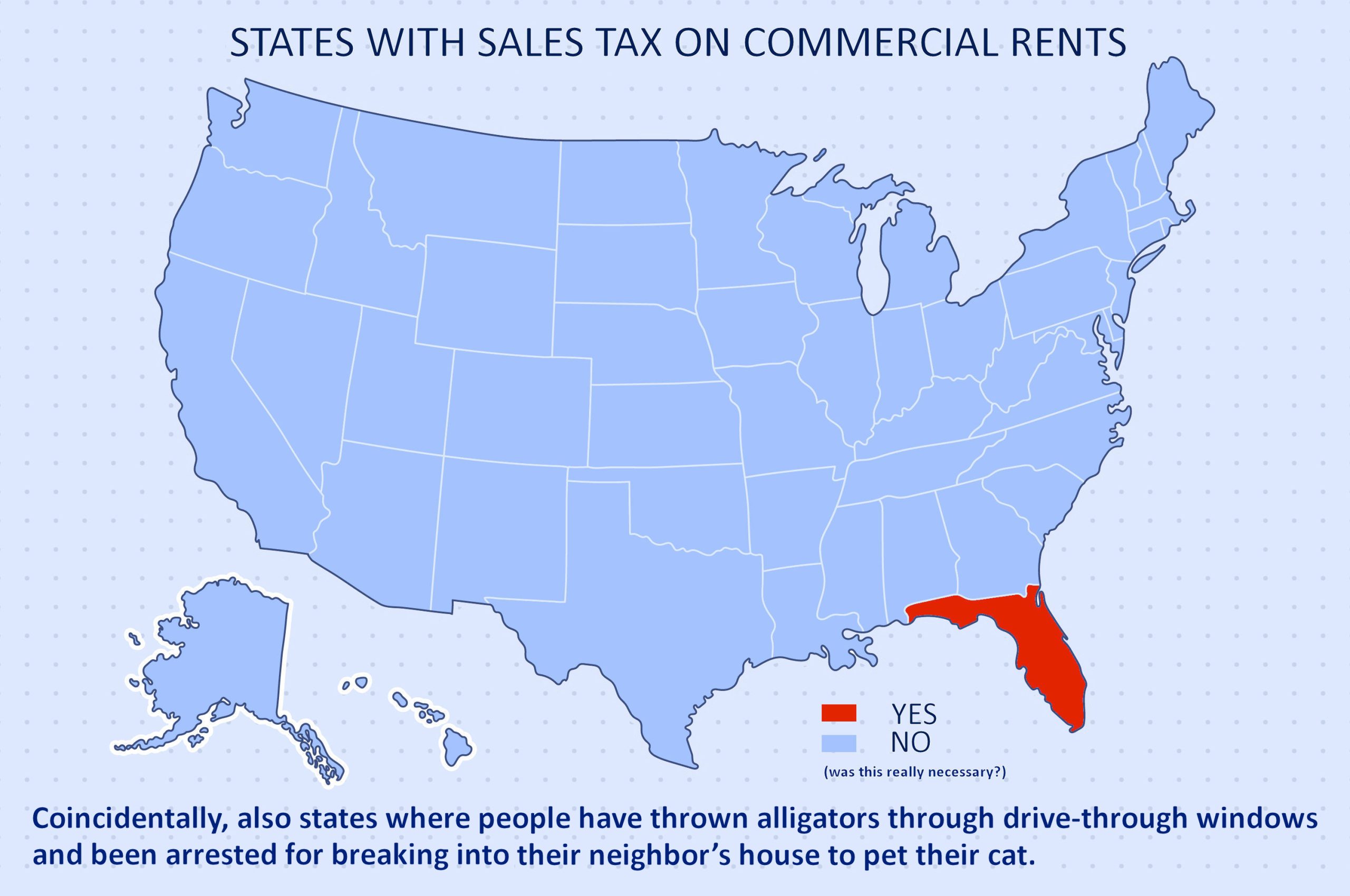

Back in May 2023, I posted an article on the Florida state sales tax on commercial rent. Florida is a unique state in many ways. But one lesser-known fact is that we are the only state that charges sales tax on rents for commercial real estate. But as of March 31, 2024, it is official. The State Unemployment Compensation Fund has exceeded the pre-pandemic level of $4.07 Billion which triggers a reduction in the State sales tax on rents from 4.5 percent to 2 percent effective June 1, 2024. In Miami-Dade, Broward and Palm Beach Counties, where I work, there is a 1 percent surcharge, so my clients will see their sales tax reduced from 5.5 percent to 3 percent.

Adding in the one percent reduction that took place in December 2023, that is a 3.5 percent reduction over a 6-month period. As a commercial tenant representation specialist, I work hard to negotiate the best rates on the ideal space for my clients. I can’t take credit for this reduction, but I am happy to spread the word, and my little blog seems to be scooping the news media. Now I know how Oprah feels – you get a 2.5% reduction…you get a 2.5% reduction.

This all goes back to April 2021, with the passage of Senate Bill 50 on taxation. A key provision in the bill was that the sales tax reduction on rents would be effective on the first day of the second full month after the Florida Unemployment Compensation Trust Fund exceeded the pre-COVID level of $4.07 Billion.

Since I wrote my article, which was number 7 on the CRE-Sources most read stories of 2023, I have been in touch with my contact at the Florida Legislature Office of Economic and Demographic Research. At that time, the forecast was for the fund to cross the threshold in May 2024, triggering the reduction in August. But earlier this year, I saw that the forecast had changed to March, indicating a reduction in June.

Since I wrote my article, which was number 7 on the CRE-Sources most read stories of 2023, I have been in touch with my contact at the Florida Legislature Office of Economic and Demographic Research. At that time, the forecast was for the fund to cross the threshold in May 2024, triggering the reduction in August. But earlier this year, I saw that the forecast had changed to March, indicating a reduction in June.

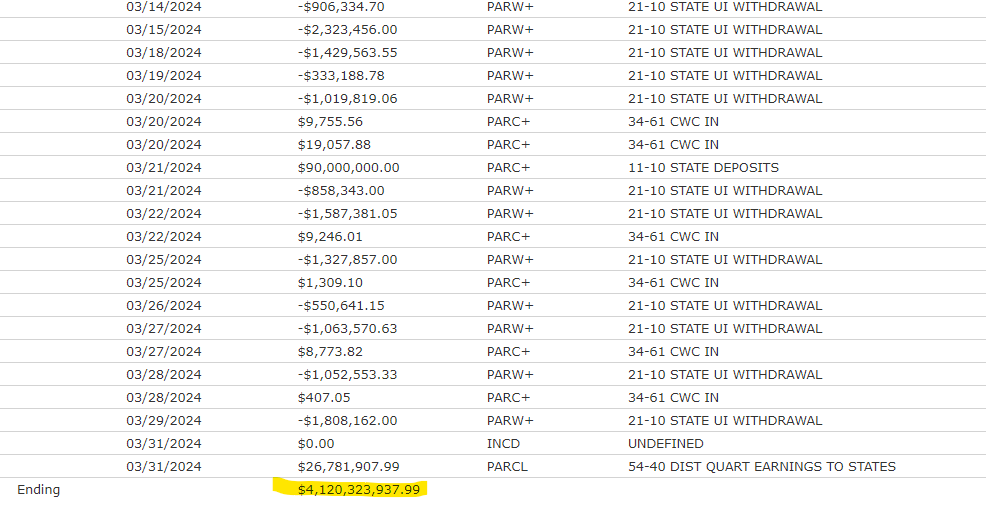

I was told to check the fund balance in the first couple of days of April, which would make the reduction official. I got the confirmation from the State and Federal Government on April 2. (I generally don’t trust anything I read on April 1.) As of March 31, the balance was $4,120,323,937.99, which means that all Florida businesses leasing commercial space will have their sales tax reduced in June.

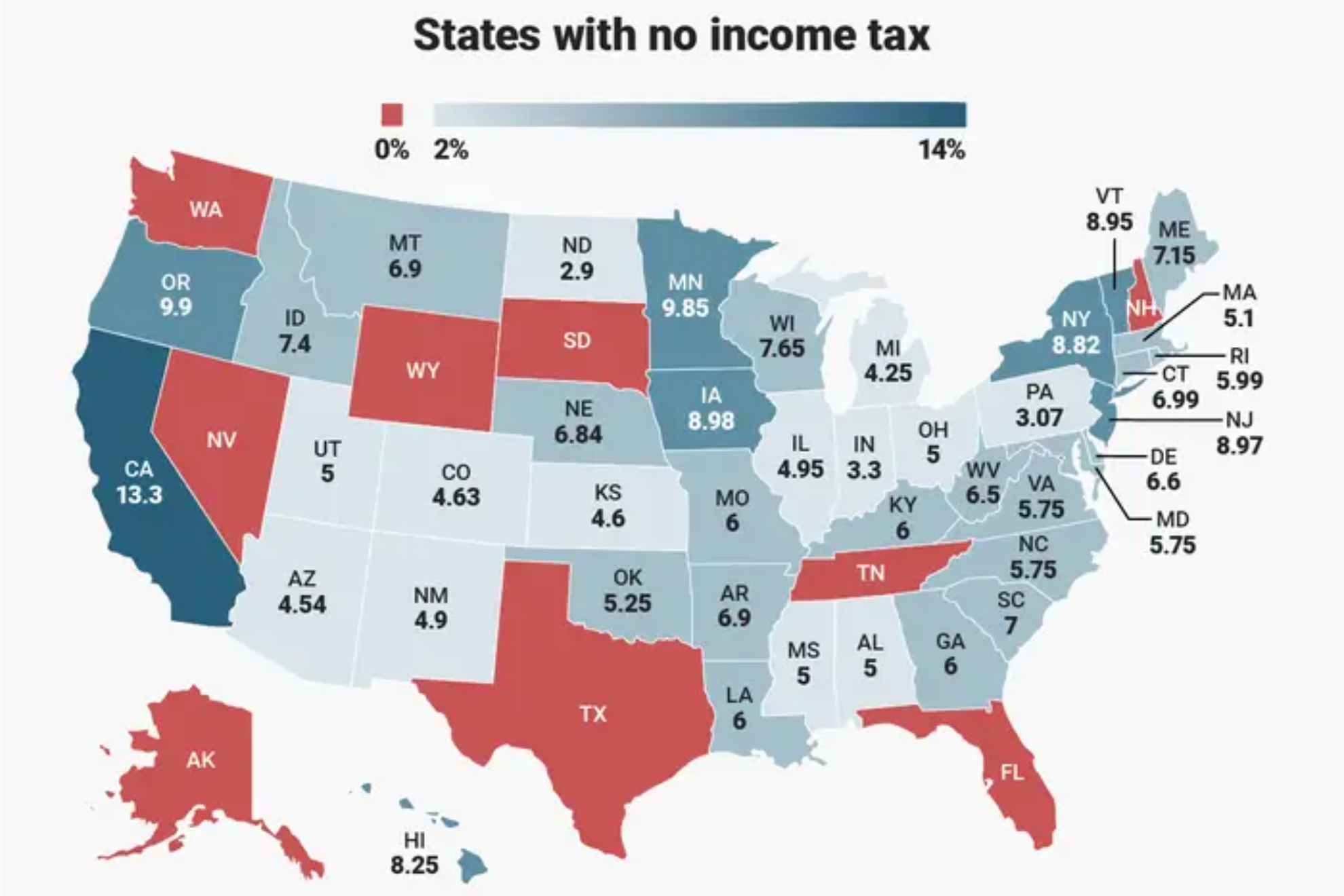

So, what does this mean for your business? For an average office tenant paying $36 per square foot, the 2.5% reduction saves them $0.90 per sf. That’s $2,700 per year for a 3,000 square foot tenant. But for a company looking to relocate from New York and lease 100,000 square feet for 10 years, that is nearly $1 million in savings. That incentive is the reason behind the reduction. Florida is also one of eight states with no state income tax. So, employees relocating to Florida can save an additional 4 % to 10.9% percent off of their taxes.

That is more good news for the Florida economy and our commercial real estate market. While we are seeing commercial markets soften in other parts of the country, South Florida continues to buck the trend.

Finding the best deals on the ideal space for your business in South Florida takes experience, market knowledge and strong connections. You need someone on your team with a wikipedic (used to be encyclopedic) knowledge of the market, the buildings, the players, and the process.

While I may be a part-time Oprah and award-winning blogger, I am a full-time tenant representation specialist. I am happy to discuss your commercial real estate needs and have been “Putting Businesses in Their Place” for over 30 years in South Florida.