Whether it’s a gallon of gas, a quart of milk or a dozen eggs. we are seeing prices rise all around us. But what is rising even faster? The cost of leasing industrial space, and more specifically, small bay warehouse in South Florida – what I call ”ind-flation”.

Commercial Edge recently reported a 4.4 percent annual increase on in-place industrial rents while CoStar reported a 10.6 percent year over year increase nationally as of April 2022. This outpaced inflation which hit a 40-year high of 8.5 percent.

But that doesn’t tell the whole story. South Florida industrial vacancies are running about 3% with the e-commerce giants dominating the market. But for the smaller tenants from 5,000 to 20,000 square feet that are the backbone of the local economy, vacancy is even lower. I believe it is significantly overstated by CoStar due to the “virtual property sign,” a trend I identified last year.

I have been working with these smaller entrepreneurial tenants for many years and I have never seen the market tighter. The rent increases I am seeing are unprecedented. In my early years as a market analyst, I reported on macro trends looking down from 30,000 feet. Today, as a tenant representation specialist, I see the market from the ground up.

While I am not always pleased with the accuracy of the information provided by CoStar, the leading provider of commercial real estate data, they do provide an excellent historical record of asking rental rates. And that data is supported by proposals I have negotiated with some of the top industrial landlords in the US.

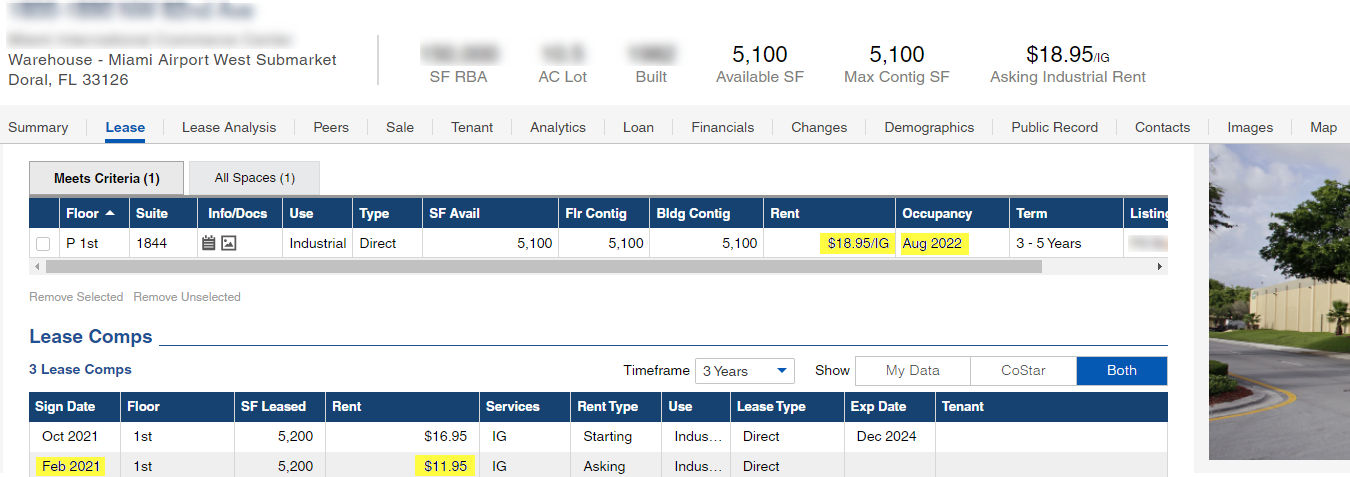

At the top of the page is a listing for one of the largest industrial parks in Miami. A 5,000 square foot space that leased for $11.95 per sf in February 2021 is now at $18.95. That’s a 59 percent increase on the gross rent which includes operating expense. On a net basis, which determines the return to investors and the overall value of the property, the increase was closer to 75 percent. Can they really achieve those rates? According to my calculations, the 3 million square feet in that park is 99.7 percent leased, so they shouldn’t have a problem.

Just wanted to add that the date 4/20 marks the second anniversary of my most popular blog post ever. Just in case you missed it.

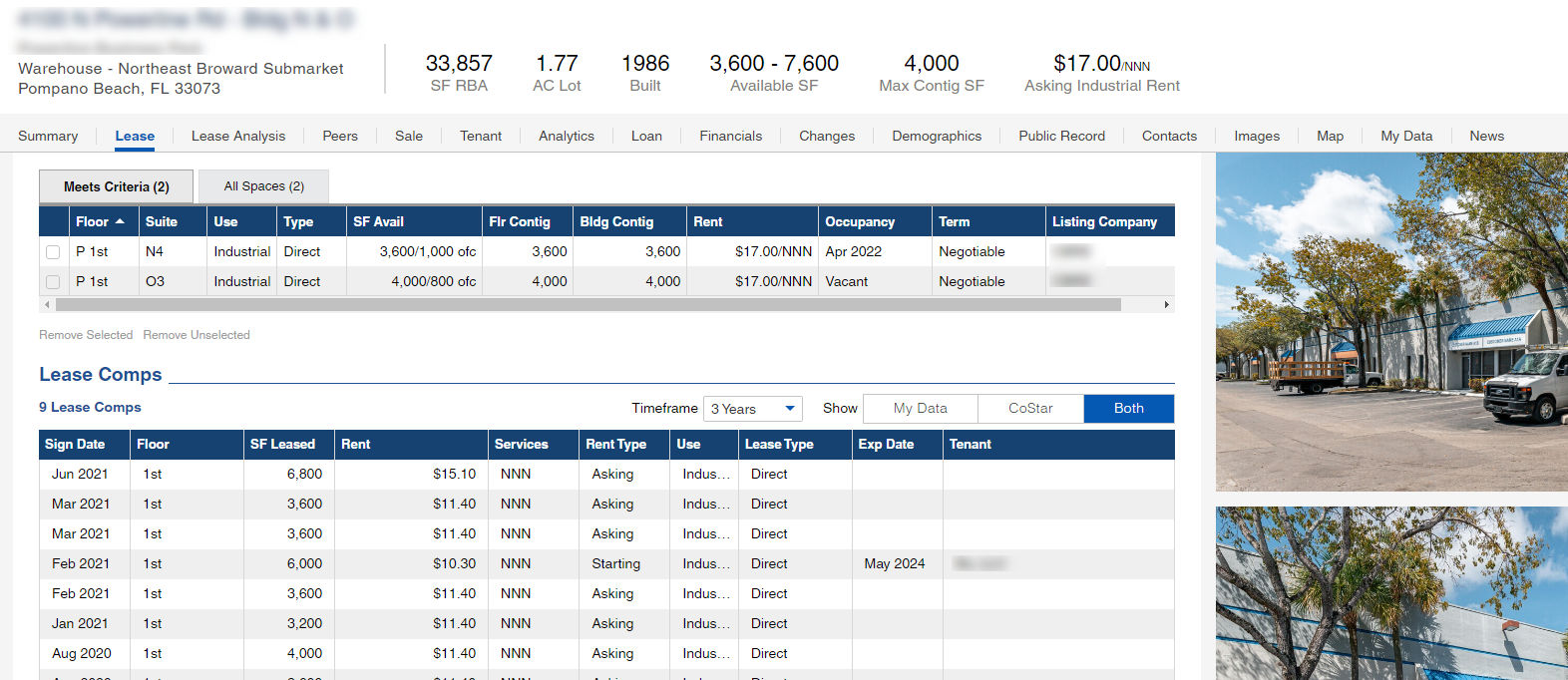

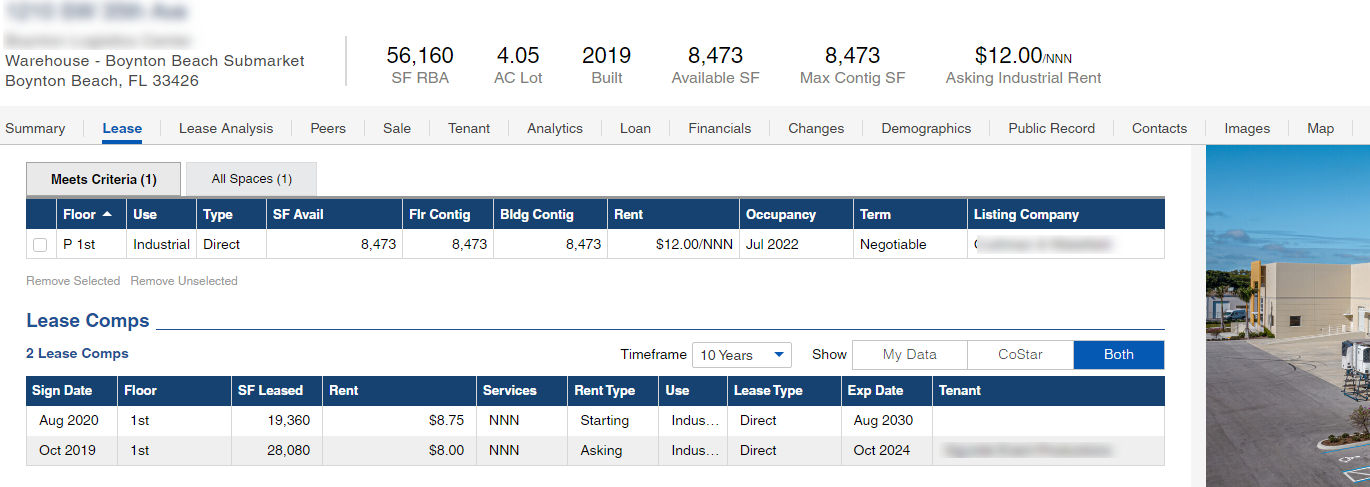

Moving to Pompano Beach in Broward County, a space in a similar industrial park that rented for $11.40 net in February 2021 is up to $17, up 49 percent in one year. Below that is one in Palm Beach County which leased for $8.75 plus expenses less than 2 years ago. It is now shown at $12 and I was just quoted $14 on that space. Rents are rising so quickly that online listings can’t keep up. These are not isolated cases; this is what we are seeing across the market.

So where do we go from here? It’s a great time to own industrial property in South Florida. It’s a scary time to be a tenant. Space is leasing faster than we can build it and we are very quickly running out of land to build it on. Our population continues to surge which means more products to be consumed and more demand for warehousing. While I don’t foresee rent increases like we have in the past year, demand continues to exceed supply, particularly in the small bay space. Rents will continue to rise as long as businesses are able pay them. As real estate only accounts for 5-10 percent of a company’s expenses, tenants will have to pass some of this cost to consumers, but higher rents should be sustainable for most companies. There has been some sticker shock at renewal time, but we have seen no reduction in demand as prices have risen.

So where do we go from here? It’s a great time to own industrial property in South Florida. It’s a scary time to be a tenant. Space is leasing faster than we can build it and we are very quickly running out of land to build it on. Our population continues to surge which means more products to be consumed and more demand for warehousing. While I don’t foresee rent increases like we have in the past year, demand continues to exceed supply, particularly in the small bay space. Rents will continue to rise as long as businesses are able pay them. As real estate only accounts for 5-10 percent of a company’s expenses, tenants will have to pass some of this cost to consumers, but higher rents should be sustainable for most companies. There has been some sticker shock at renewal time, but we have seen no reduction in demand as prices have risen.

While many are waiting for the bubble to burst, I don’t see it happening any time soon. Growth will eventually slow, but strong demand and limited supply indicate continued growth in industrial rents and property values. As a tenant representative it is getting increasingly more difficult to find the right space for my clients. But with the market changing faster than online listings can keep up, it is important to have someone on your side who tracks the market from the ground up every day. I will continue to stay on top of the market on a daily basis, not just to help my clients find space, but also to identify the increasingly elusive concept of value.