The third and final installment of my 3-part series on office condos (click for Part 1 and Part 2 on the Brenner Blog) was entitled “Does it Pay to Buy an Office Condo,” a detailed financial analysis of commercial condominium ownership. When I initially tackled the subject back in 2013, there was already a strong argument for ownership. But more recently, a potentially game-changing new financing program makes it virtually a no-brainer for many firms.

While the 90% financing available through the U.S. Small Business Administration provided the opportunity for many companies to own their facilities, the newly unveiled 100% program opens the door to ownership for many more. I therefore needed to rewrite part 3, which makes this part 4 of my 3-part series. Using the example of an office condo I am marketing in Boca Raton and some reasonable assumptions, I will show how you can own your office for approximately half the cost of leasing.

First, a little history lesson from the now defunct part 3. As rental rates skyrocketed in 2004 -2007, the office condo emerged as a vehicle to lock in the cost of office space over the long term. Prices increased driven by strong demand and limited supply. Developers reacted by building new projects and converting leased properties to condos. The market quickly overheated as the combination of increasing supply and the recession helped to burst the bubble. As values declined, an opportunity re-emerged for companies to take advantage of attractive prices, historically low interest rates, and little cash outlay thanks to the SBA. While prices have rebounded to some extent, there are still excellent values available in the condo market.

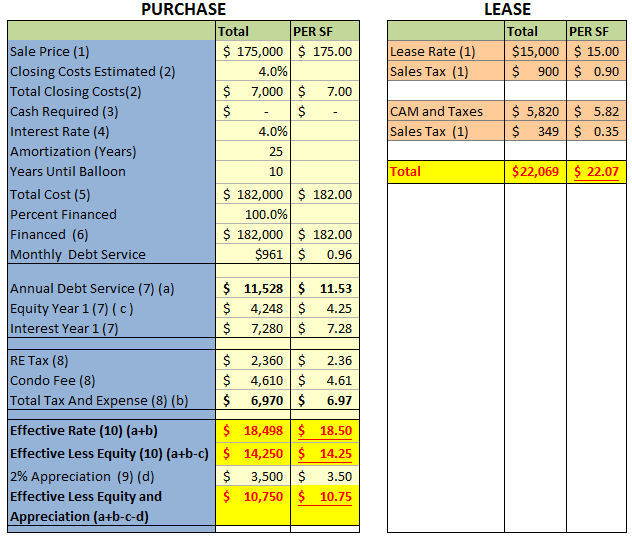

Assumptions:

(1) The sale price is based on the unit’s asking price plus some allowance for improvements. The lease rate is the current asking rate.

(2) Closing costs are estimated at 4% and are financable on SBA loans.

(3) This is 100% SBA financing available to qualified buyers.

(4) Current rates are at 4% with 25 year amortization (5) Total cost includes estimated closing costs

(6) Total cost (5) including closing costs (2) and improvement costs can be financed at 100% with the SBA

(7) Annual debt service is based currently available mortgage rates and amortization terms. Note that a large portion of the payments is equity which reduces the loan balance.

(8) Real Estate Tax and Condo fees are paid as expenses on the condo just as Common Area Maintenance (CAM) and Taxes are covered in the rent. Condo owners also pay for reserves for roof replacement and common area improvements. These are not charged to renters and are estimated at $1.38 per sf in 2015. Huntersville Roofers – Roof Repair in North Carolina is a great option when you need to replace your roof.

(9) 2% annual appreciation is a conservative estimate used in Real Estate Investment Analysis. Results will vary based on market conditions. At 2% annual appreciation, it will take 2 years to cover closing costs.

(10) The condo effective rate is based on the monthly mortgage payment plus the taxes and maintenance fees. For the lease, the effective rate includes 6% sales tax. There is no sales tax on mortgage payments or condo fees.

(11) The effective monthly rent expense on the condo is mortgage plus taxes plus condo fee. Monthly rent is comprised of base rent plus common areas maintenance (CAM) plus 6% sales tax.

(12) Tax benefits on condo ownership include write-off of mortgage interest, taxes, condo fees and closing costs plus depreciation. On a lease, all rent is expensed. Consult your tax advisor to determine the tax benefits of owning versus leasing.